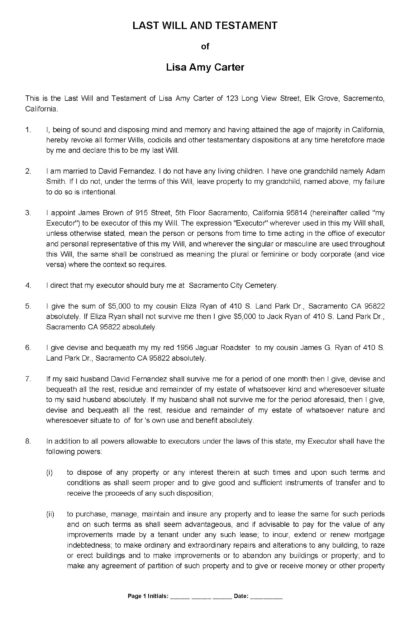

Convertible Loan Agreement (Individual to Company) (Interest Free)

This is an interest free convertible loan agreement pursuant to which an individual lends money to a corporate borrower. The convertible loan agreement entitles the lender to convert the loan amount into shares in the borrower company if he or she so wishes.

The convertible loan agreement sets out details of the loan to be advanced by the lender to the corporate borrower, when the corporate borrower can draw down or obtain the funds, the dates upon which the loan must be repaid (whether in whole or in part) and, if in part, in what amounts, and default terms which set out the terms upon which the loan shall become immediately repayable by the corporate borrower to the lender if there is a breach of the convertible loan agreement by the corporate borrower.

Further details are set out below.

Updated:

April 2023

Delivery:

Immediate download

Format:

![]() Microsoft Word

Microsoft Word

Overview

This is an interest free convertible loan agreement which sets out the basis upon which a lender will lend monies to a corporate borrower.

The convertible loan agreement is drafted on the basis that, having been signed by the lender and the corporate borrower, the lender will be obliged to advance the loan monies to the corporate borrower upon receipt of a written request from the corporate borrower (drawdown notice) to advance the funds. A number of options have been included in the convertible loan agreement to allow for the loan amount to be drawn down in one or more tranches and to set out the dates on which such drawdowns can take place. In each case, the corporate borrower will need to provide the lender with a specific amount of advance notice before it can drawdown the loan monies. If you wish, you can also add specific conditions that must be satisfied before the loan or part of the loan can be drawn down.

Under the convertible loan agreement, no interest will be payable on the loan amount. However, the interest clause leaves scope for the parties to agree that interest will be chargeable on a later date. If the parties later agree that interest will be chargeable and payable at a later date, it will be necessary to document the rate of interest payable, the dates on which it will be paid, the period in respect of which interest will be charged, the rate of interest, whether the interest compounds daily, monthly, quarterly, etc.

The repayment provisions in the convertible loan agreement contain options to allow you to state whether the loan amount is to be repaid in full on a given date or in periodical instalments (i.e. weekly, monthly, annually, etc.). It also gives the corporate borrower an option to make an early repayment of the loan amount if it so wishes. The clause can be customised as you require.

The total amount outstanding under the loan can be converted to shares in the borrower at a set price per share at the option of the lender (note that the clause can be amended so the borrower has this option). If there is any form of adjustment event in relation to the share capital of the corporate borrower, that will be taken into account in determining how many shares the lender is entitled to receive. Where an element of the outstanding loan is converted into shares, the amount of the loan will fall by the value of the loan utilised in the conversion.

The convertible loan agreement also contains a default interest clause. So, while interest may or may not be charged on the outstanding loan amount, interest will be charged at a specific rate on any amount that the corporate borrower is late in repaying to the lender. This default interest rate shall be payable in respect of the overdue amount for so long as it remains overdue.

The corporate borrower will be required to give certain representations and covenants to the lender under the terms of the convertible loan agreement. It is on the basis of these representations and covenants being true and accurate that the lender will agree to advance the loan monies to the corporate borrower. If it turns out that the corporate borrower has incorrectly given these representations and covenants, the lender can call for the immediate repayment of the loan monies by the corporate borrower and, if he wishes, take legal action against the corporate borrower to recover those monies.

A default clause has been included in the convertible loan agreement which sets out a number of circumstances, known as defaults, which if they occur will entitle the lender to immediately call for the repayment of the entire loan amount.

The convertible loan agreement also contains standard ‘boiler plate’ clauses and other clauses typically found in convertible loan agreements of this kind.

Detailed information in relation to each clause of this convertible loan agreement and on how to complete the convertible loan agreement are contained in the notes that accompany the agreement.

Clauses Included in this Convertible Loan Agreement:

- Defined Terms Clause

- Loan Clause

- Drawdown of Loan Clause

- Interest Clause

- Repayment by the Borrower Clause

- Conversion Clause

- Conversion Price Adjustment Clause

- Representations and Covenants Clause

- Default Clause

- Waiver Clause

- Notices Clause

- Confidentiality Clause

- Amendments Clause

- Counterparts Clause

- Severance Clause

- Assignment Clause

- Entire Agreement Clause

- Governing Law and Jurisdiction Clause

Why Choose DocuDraft

We’re proud to have helped thousands of people make online legal documents over the past 20 years.

- Save Money – Our service is simpler and cheaper than using a solicitor.

- Solicitor Prepared Documents – You will be using documents which have been prepared, reviewed and pre-approved by solicitors with years of document drafting experience.

- Compliant with English Law – You will be using tried and tested legal documents specifically tailored to comply with the laws of England & Wales.

- Advanced Features – Your documents will contain advanced solicitor-approved provisions not usually found in standard run-of-the-mill documents you find online.

- 20 Years in Business – DocuDraft was one of the first businesses to start selling legal documents online in the UK back in 2000.

- Trusted by Thousands – We have helped thousands of people in the UK to make legal documents over the past 20 years.

- Bank Level Security – Your information is encrypted and secured safely using the same encryption technology used by banks.

Managed by Solicitors

DocuDraft was founded in 2000 by, and is managed by, experienced UK solicitors who are recognised experts in their fields.

Easy to Use

We use our 20+ years of experience to help you figure out what you really want in a simple jargon-free way.

Help at Every Stage

Our customers are everything to us. So, we provide help to you at every stage of the document creation process.

Reviews

We’ve helped raise millions for charity through donations left in our customers’ wills…

Our expert legal team is here to help

- Expert support every step of the way

- Phone or send us a message online

- Phone lines open 9am-5pm, Monday to Friday

Confirm Your Email Address to Receive Your Discount

, thanks for joining EstateBee.

To receive your 20% discount code, you’ll need to verify your email address and activate your account.

We’ve sent an activation link to you by email to . Just click on the link in the email, confirm your details and you’re good to go.

Best Wishes,

EstateBee Team