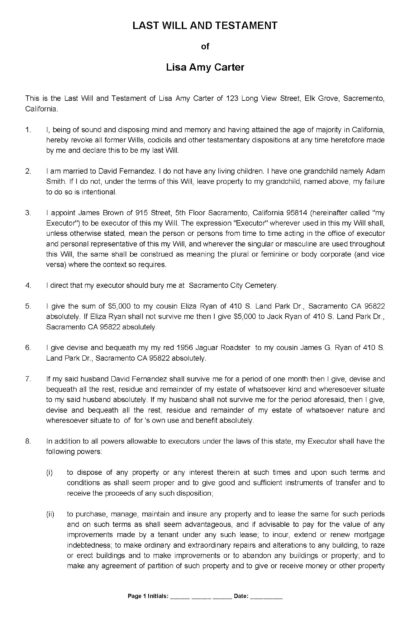

Share Purchase Agreement (Short Form) – Multiple Sellers

This share purchase agreement sets out the basis upon which two or more parties will sell and another party will purchase shares in the capital of a company.

The agreement contains details of the parties involved, the shares, the price to be paid for the shares, when and how completion of the sale and purchase will take place, what will need to happen on completion, what legal assurances the buyer gets from the sellers in relation to the sale shares and the affairs of the company, and so on.

The buyer will purchase the shares on the basis of receiving the benefit of warranties from the sellers in relation to the sale shares and the sellers’ title to and ability to sell those shares.

Further details are set out below.

Updated:

April 2023

Delivery:

Immediate download

Format:

![]() Microsoft Word

Microsoft Word

Overview

A share purchase agreement sets out the basis upon which one party will sell and another party will purchase shares in the capital of a company. The agreement contains details of the parties involved, the shares, the price to be paid for the shares, when and how completion of the sale and purchase will take place, what will need to happen on completion, what legal assurances the buyer gets from the sellers in relation to their shares and the affairs of the company, and so on.

Under the terms of this share purchase agreement, the sale and purchase of the sale shares will take place on the date that the parties sign and date the share purchase agreement. On that date (the completion date), the sellers will deliver duly executed stock transfer forms in respect of the sale shares to the buyer together with the share certificates for those shares. In turn, the buyer will deliver the purchase price to the sellers.

A meeting of the board of directors of the company will be convened at which the board will approve the transfers of the shares from the sellers to the buyer, write up the company’s share register and issues a new share certificate to the buyer in respect of the shares he has purchased.

In connection with the sale and purchase of the shares, the sellers will give certain warranties or legal assurances to the buyer in relation to both their sale shares and their ability to sell those shares. These warranties will generally relate to matters such as the seller’s title to the sale shares, his right to sell them, the fact that there are no security interests or encumbrances of any kind over the shares, etc.

These warranties are important because absent them being true and correct, the sellers may not have the required legal rights to transfer the sale shares to the buyer. If they are incorrect in any way and it materialises that the buyer has not acquired full legal title, the buyer will be able to take a legal claim against one or both of the sellers for breaching the warranties. This claim is called a warranty claim and certain limitations will apply to the taking of such claims – as more specifically described in the notes which accompany the share purchase agreement.

The limitations to warranty claims set out above will not, however, apply where there is a defect in the sellers’ title to the sale shares or where any of the sellers has acted in a fraudulent manner or in a manner which has delayed the taking of a warranty claim.

The share purchase agreement also includes standard boiler plate clauses such as in relation to confidentiality, notice requirements, governing laws, etc.

Who should use this share purchase agreement?

As this share purchase agreement is a short form share purchase agreement, it is most suitable for use where:

(i) the buyer is already familiar with the target company (such as where the buyer is already a director or shareholder of the target company); or

(ii) there is a close link between the buyer and the sellers– such as where they are family members, for example – and there is an element of trust involved in the purchase.

The reason for this is that this short form share purchase agreement does not, unlike the long form version, contain pages of warranties about the company’s business, accounts, assets, employees, litigation, etc. In this case, it is taken that the buyer is aware of all of this and is happy to purchase the sale shares regardless. If the buyer wishes to add any extra warranties, he will most likely be able to find the warranties in the “long form warranties” document available from our website.

A long form version of a share purchase agreement is available on our website.

Detailed instructions on each of the clauses in this share purchase agreement and on completing the share purchase agreement are contained in the notes that accompany the agreement. The share purchase agreement comes in downloadable format.

Clauses Included in this Share Purchase Agreement:

- Definition and Interpretation Clause

- Sale and Purchase Clause

- Consideration Clause

- Completion Clause

- Warranties Clause

- Notices Clause

- Confidentiality Clause

- Costs Clause

- Assignment Clause

- Amendments Clause

- Waiver Clause

- Severability Clause

- Counterparts Clause

- Entire Agreement Clause

- Governing Law and Jurisdiction Clause

- Schedule 1 – Details of Target Company

- Schedule 2 – Documents/Items Delivered on Completion

- Schedule 3 – Warranties

Why Choose DocuDraft

We’re proud to have helped thousands of people make online legal documents over the past 20 years.

- Save Money – Our service is simpler and cheaper than using a solicitor.

- Solicitor Prepared Documents – You will be using documents which have been prepared, reviewed and pre-approved by solicitors with years of document drafting experience.

- Compliant with English Law – You will be using tried and tested legal documents specifically tailored to comply with the laws of England & Wales.

- Advanced Features – Your documents will contain advanced solicitor-approved provisions not usually found in standard run-of-the-mill documents you find online.

- 20 Years in Business – DocuDraft was one of the first businesses to start selling legal documents online in the UK back in 2000.

- Trusted by Thousands – We have helped thousands of people in the UK to make legal documents over the past 20 years.

- Bank Level Security – Your information is encrypted and secured safely using the same encryption technology used by banks.

Managed by Solicitors

DocuDraft was founded in 2000 by, and is managed by, experienced UK solicitors who are recognised experts in their fields.

Easy to Use

We use our 20+ years of experience to help you figure out what you really want in a simple jargon-free way.

Help at Every Stage

Our customers are everything to us. So, we provide help to you at every stage of the document creation process.

Reviews

We’ve helped raise millions for charity through donations left in our customers’ wills…

Our expert legal team is here to help

- Expert support every step of the way

- Phone or send us a message online

- Phone lines open 9am-5pm, Monday to Friday

Confirm Your Email Address to Receive Your Discount

, thanks for joining EstateBee.

To receive your 20% discount code, you’ll need to verify your email address and activate your account.

We’ve sent an activation link to you by email to . Just click on the link in the email, confirm your details and you’re good to go.

Best Wishes,

EstateBee Team